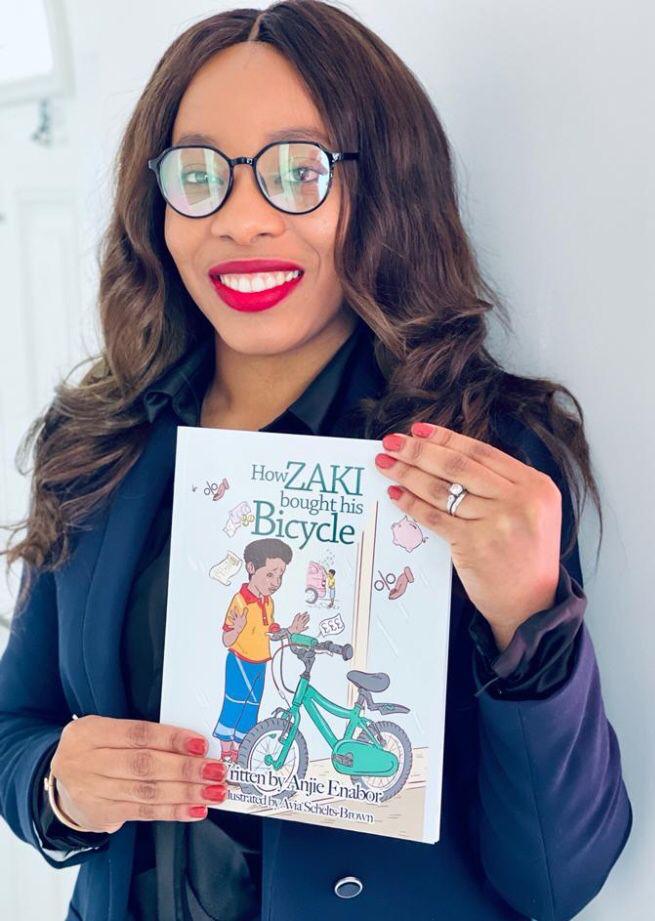

Meet Anjie Enabor (Financial Literacy Coach)

Anjie Enabor (FCCA) is a financial educator that is passionate about early development psychology. She is passionate about financial literacy, and introducing the key pillars of personal finance which are: budgeting, saving, investing and giving to children from a young age; as early as 4 years old.

Inspired by her upbringing and a seemingly fearless, relaxed and empowered approach to money, she set about a personal research to find out why friends around her had a different attitude to money. Spending lavishly when they had it, and being afraid and anxious when they did not have it. She soon found out that money habits are passed on from one generation to the other, and that a person’s upbringing and the family’s attitude to money while growing up impacted the way they viewed money as an adult.

Challenged by this, she set about demystifying money to friends and their children. In her own words, ‘Financial literacy is a possession of the set of skills and knowledge that allows an individual to make informed and effective decisions with their financial resources. This leads to an overall sense of financial well-being and self-trust.

She believes that true financial literacy does not mean being rich or having lots of things. It is simply a state of being that empowers you to feel confident about what you have, and having a plan to get to where you need to get to.

She has self-published the following books: ‘How Zaki bought his bicycle’ & ‘Zaki’s A-Z Finance words’, both available on Amazon. She believes that families can change their financial legacy by starting financial literacy early.

Coaching categories

For tailored financial guidance, book a session with Anjie Enabor (FCCA). Anjie offers professional, one-on-one support to address your specific needs and financial literacy goals.

FREE 15 Mins Discovery Call

We discuss your objectives and ascertain if my approach is the right fit for you and your child. These calls are free and do not constitute a coach/client relationship or have a contractual agreement. If you are unable to make your call, please let us know 24 hours ahead of your appointment. Repeat appointments are unavailable to no-shows.

This session is FREE

| Outcomes: |

| 1. Clear financial goals |

| 2. Personalised action plan |

| 3. Confidence with tools to move forward |

1 : 1 Coaching

These are 1hr:30min sessions, booked in clusters of 3. They are designed specifically to address areas of concern or learning for the parent, guardian or child. Based on the objectives set out in the discovery call, we identify 1 issue per session and thoroughly explore it until a clear understanding is reached.

There may be homework after each session which you are required to complete in order to make this worth your while. We will offer you some of the materials needed to consolidate your learning during each session.

If you need to be referred to a tax or investment specialist, we will make a no obligation recommendation with accredited sources. You are responsible for carrying out the necessary due diligence required before working with any 3rd party agent.

Strategy Session

This is a 2 hours strategy session, where we jointly design a workable strategy for you and your child based on the objectives discussed in your discovery call. I believe that each child and family is unique, and do not provide a one size fits all strategy for families. We will offer some free material to help you on your way to financial literacy, but you will have to implement these strategies by yourself.

Once your strategy is designed, we offer a follow on 15 minutes session for questions or clarifications free of charge.

If you need to be referred to a tax or investment specialist, we will make a no obligation recommendation with accredited sources. You are responsible for carrying out the necessary due diligence required before working with any 3rd party agent.